LLCs are more subject to regulations than traditional corporate bodies. This allows members to design more flexible management structures than other corporate forms. As long as the LLC is within the limits of state law, the operating agreements determine how flexible the LLC members will be governed. Learn more about company registration in Estonia

It is not required to have officers and directors, board or shareholder meeting meetings, or any other administrative burdens that come along with owning a company. Because LLCs can often be pass-through entities their owners can claim the Tax Cuts and Jobs Act's special pass-through tax deduction.

A federal tax classification rule allows an LLC to have both structural flexibility and favorable tax treatment. Nevertheless, persons contemplating forming an LLC are well-advised to consult competent legal counsel. LLC stands for "limited liability company." An LLC is a legal entity that can either be owned or operated by a business. LLCs are very popular because they provide the same limited liability as a corporation, but are easier and cheaper to form and run. An LLC might be better than a general partner because the LLC member is exempt from all liability that the general partners are subject to. Some states allow individuals who are not limited-liability partners to form them. This type of business entity is exempt from liability for partners' debts or actions.

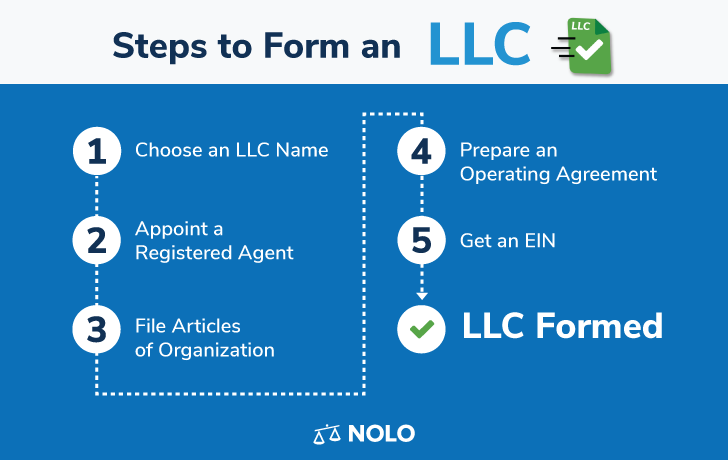

That generally requires filing an application for authority with the Secretary of State. A registered agent must also be appointed and maintained by the LLC.

These include important legal documents and notices, communications, and communications mailed out by the Secretary-of-State and tax documents sent out by the state's taxation division. A registered agent must also be available for service of process, which is legal documents (typically a complaint or summons) that inform the LLC that a lawsuit has already been filed. Other court documents, including garnishment orders and subpoenas, can also be served upon the registered agent. An LLC operating contract is a document that customizes terms for a limited-liability business to meet the needs of its owners. Instead, profits, as well as losses, are listed on individual tax returns. Or, an LLC may choose to be classified differently, such as a company. B) The income or losses of an LLC are not passed on to the members' individual income tax returns.

LLCs may have one owner (known as a "member") and many owners. Due to the limited liability feature, it becomes easier to scale up the business without risking your personal assets. The LLC allows pass-through taxation as its income does not have to be taxed at the entity or entity level. However, it is necessary to complete a tax return for the LLC if there is more than one owner. The owner is liable for any income or loss from an LLC as indicated on this return. Owners, also called members must then report the income and loss on their personal taxes returns and pay any applicable tax.

Is It Better To Have An Llc Or Dba?

It outlines the member capital contributions, ownership percentages, and management structure. An operating agreement, which is similar to a prenuptial arrangement, can prevent future disputes between members by addressing buyout rights, valuation formulas, and transfer restrictions. The written LLC operating agreement should be signed by all of its members. When you form an LLC, your business becomes its own legal entity, with separate debts and legal matters.

This means that only designated members, or certain nonmembers/outsiders, or a combination of members and nonmembers, are given the responsibility to run the business. A manager-managed LLC is made up of passive investors, who are not directly involved in business operations. This type of management is desirable for large LLCs that have many members or where some members are passive investors in the business.

Understanding Corporations

This method allows all members to share responsibility in the day-to-day running of the business. This approach is more common because LLCs are small businesses with limited resources, and they don’t require separate management to operate.

If you don't plan on raising investment money for your business, think you might need asset protection, and need flexible business management and taxes, then an LLC is likely the best choice for your business. Incfile works with all sizes and verticals businesses to form an LLC. We have LLCs for financial advisors, real estate agents, and solopreneurs. A number of entrepreneurs decide that an LLC is the business structure that fits their needs. A limited liability company is a popular choice for small-business owners because of the liability protection, management flexibility, tax advantages, and tax advantages this type of entity often provides.